Data Solution

Regulatory Reporting

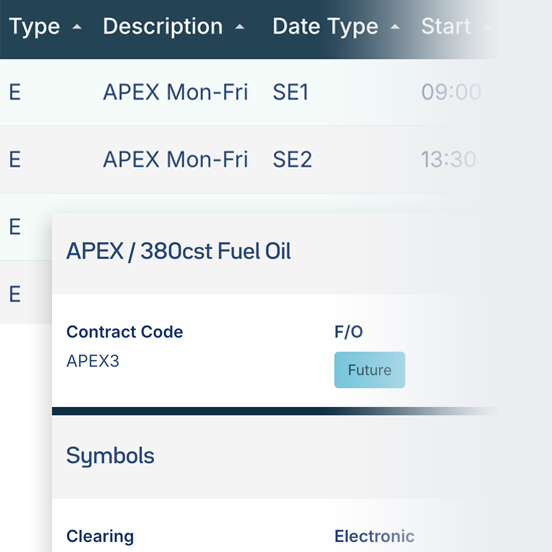

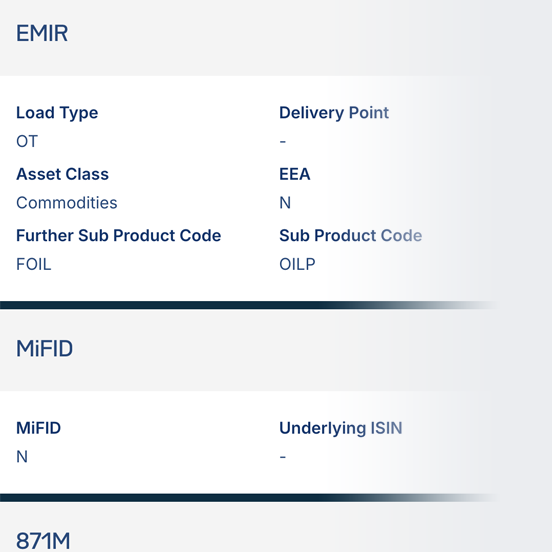

Comply with ever-evolving regulatory reporting rules. Our data provides attributes specifically built to enhance regulatory reporting across your asset classes and exchanges.

Reduce compliance risk

Enhance reports and minimise transaction reporting errors with the most accurate reference data available, reducing compliance failure and associated risk.

Optimise trade reconciliation

Accurate and validated data, formatted as required for internal EDM and external reporting workflows, reduces trade reconciliation errors and fails.

Trade new products with certainty

Improve confidence when trading new products with the correct regulatory attributes.

Data delivery in the format you need

Our data solutions can be accessed on demand within our data platform or in a range of formats and scales to fit operational requirements.

All the fields and filtering that we need isn't provided by the trading systems, so you need the third-party reference data that FOW provides to do that screening and filtering and report correctly, but also to give the extra product information that the regulator is looking for.

Sell Side T2, Head of IT Development

Featured case study

Regulated multilateral trading platform needing to respond quickly to changing regulatory reporting obligations

Read Case Study

Request a Free Trial

Find out how you can benefit from a seamless access to FOW’s extensive data, market analytics and industry insights.

Submit

Explore Our Other Data Solutions

25+ years sourcing and curating the best quality reference data into solutions to meet all your trading, operations and reporting needs.

Related Insights

Gain better insights into the value and quality of our data and how it can support your business needs.